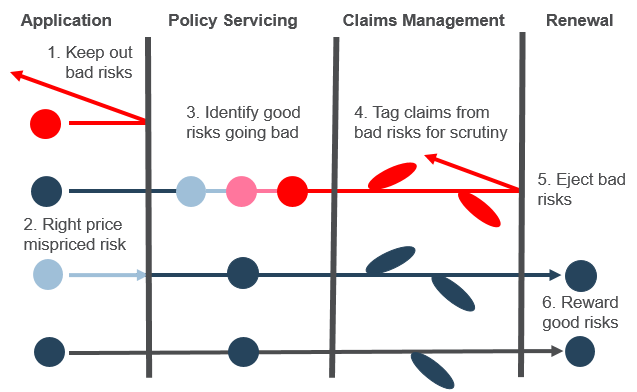

Across the insurance policy cycle there are six crucial points where having a clear insight into the truthfulness and intentions of customers can go a long way towards eliminated excess risk and improving the quality of your book. It’s essential that risk selection efforts focus on each of these dimensions. Failing to do so simply turns risk selection into and exercise in ‘Whack a Mole” where risks that are detected at application disappear only to surface at endorsement. Or when poor behavior at endorsement isn’t taken into account at renewal. Effective risk selection is holistic. Which requires a complete view of both the insurance data and the associated customer and agent behavioral data.

Key Points for Risk Selection Management