Pick the risks you want, skip the ones you don't

Automated Risk Selection and CX Solutions for P&C Insurers

Undermanaged Risk

Loss Ratios

Business You Want

IT Resources

Costs

Superior Risk Selection Throughout the policy lifecycle

Pick the risks you want, skip the ones you don't

Automated Risk Selection and CX Solutions for P&C Insurers

Superior Risk Selection Drives Profitable Growth

Accelerate Innovation at point of sale in minutes, not months

Automated Risk Selection and CX Solutions for P&C Insurers

respond to market change ın mınutes, not months

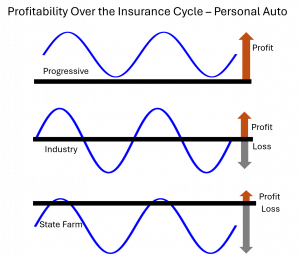

Escape the P&C boom and bust cycle

Automated Risk Selection and CX Solutions for P&C Insurers

Superior Risk Selection Drives Profitable Growth

Accelerate Innovation at point of sale in minutes, not months

Automated Risk Selection and CX Solutions for P&C Insurers

Carrier business teams detect & reduce fraud and excess risks at Point of Sale, Endorsement and Renewal

Carrier business teams systematically micro-target risk to drive loss ratios down.

Composable solutions at POS designed, tested, deployed and modified by non-specialist business users.

Micro risk targeting & filtering lets carriers find more good business in any channel, any market.

Better risk selection at POS reduces costs across the policy lifecycle

Pick the risks you want. Skip the ones you don’t.

Every customer is unique, every interaction an indicator of risk and reward. But only if you can read the signals and respond to the many exceptions and workflow variations they drive.

VeracityID gives your business teams powerful tools to build countless solutions to these opportunities in minutes, not months. Solutions that complement carrier core systems without requiring IT.

Now you have a choice.

Features That Deliver Value From Day One

DRIVE DOWN LOSS RATIOS

Discover the wide range of proven solutions that have driven down even the toughest direct channel loss ratios by over 40 points.

INNOVATE WITHOUT IT RESOURCES

Users can rapidly create, test and deploy micro-targeted workflows, risk rules, and personalized CX radically increasing the range or risks and opportunities that can be effectively addressed. Without IT.

DETER FRAUD & UNMANAGED RISKS

Detect and prevent underwriting fraud, errors, misrepresentation and manipulation before accepting risks with AI powered behavioral risk detection, micro-targeted workflow and robust policy lifecycle/historic performance measurement.

CONVERT MORE OF THE BUSINESS YOU WANT

Deploy highly targeted business rules, interventions and workflow that moves good risks to the customized, benefit rich ‘happy path’ designed to maximize conversion.

REDUCE OPERATING COSTS

Reduce underwriting and loss adjustment costs with AI-powered productivity tools such as self-service vehicle inspection, automated document capture/review, and asset condition analytics.

How it works

Discover

Fuse customer and agent data into lifecycle views of individual and book performance, events and risks

Book studies signal risk trends and opportunities by geography, channel, customer/agent attribute, and more

Customer and Agent attributes, behaviors and history are fused together to drive unique views of individual policy risk

Social Network Analytics are used to identify suspicious connections and emerging fraud networks

CREATE

Business users can create, test and deploy micro-targeted CX and risk selection workflow without IT resources

When elevated risk is detected, micro-targeted rules and interventions engage customers and agents in highly focused virtual underwriting interaction.

When an attractive risk is detected, idFusion can be configured to offer additional features and benefits designed to increase close rates.

OPERATE

Rapidly adapt to changing market conditions across channels, geographies, writing companies and market segments

Business users can now detect, analyze and rapidly develop solutions to challenges as they emerge—allowing them to target exponentially more opportunities with an increasingly fine segmentation of risks and CX

THE RESULT?

BETTER LOSS RESULTS AND A HIGHER CONVERSION RATE.

IDFUSION focuses the entire organization on what matters

Enhanced Customer Data for Claims and SIU

Delivers POS information to adjusters and investigators at point of claim, including complete record of lifecycle behaviors, images, claims, analytics, attests and records.

COMMON VIEW OF CUSTOMER ECONOMICS

Delivers detailed economic analysis of returns by customer, channel, market, agent, writing company and more. Enables ‘how many how much’ new rule valuation using the existing book.

EASILY COLLABORATE BETWEEN TEAMS AND DEPARTMENTS

Embeds claims and SIU Insights into underwriting and fraud prevention at POS. Enables seamless solution sharing across geographies, channels and writing companies.

IT Force Multiplier

idFusion’s powerful self-service solutions building tools “Liberate” scarce IT Resources so they may focus on strategic initiatives.

idFusion unites the entire organization around the "Power of Now"

- A complete, common customer data view

- Common analytical tools

- User composed (no programming)

- Designed for real time decisions and intervention at POS

Caught between the Devil and the Deep Blue Sea

Caught between the Devil and the Deep Blue Sea  When the workplace has no walls: Risk management must address the remote revolution

When the workplace has no walls: Risk management must address the remote revolution  State Farm finally turns the corner but faces a long-term problem

State Farm finally turns the corner but faces a long-term problem  The Accident Date Switcheroo

The Accident Date Switcheroo  Where’s Progressive?

Where’s Progressive?  Three AI Mistakes We See Insurance Carriers Making

Three AI Mistakes We See Insurance Carriers Making  Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse

Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse  The “Just Asking” Gambit

The “Just Asking” Gambit