idFusion unites the entire organization around the "Power of Now"

- A complete, common customer data view

- Common analytical tools

- User composed (no programming)

- Designed for real time decisions and intervention at POS

Risk Scenario Analysis

Suspicious Behavior

Tracks transactional behavior – in quote, inter-quote changes, prior policies; suspicious connections, missing data, known bad guy, suspicious event sequences such as claims near endorsements and cancel/reinstates near a claim.

Lifetime Value

Delivers a ‘Whole customer view’ from comprehensive data idFusion maintains. Components include: expected duration, NPE, multiple product vs single, LAE per claim by type, UEP, cost to serve (frequency & type of changes, inquiries), policy size (Total Revenue), acquisition costs and cancel costs.

Hot Spot Analytics

Enable identification of high loss & high profit segments by geography, demography, channel, attributes, behavior, LTVC, risk scores and other strategic details.

Serial Behaviors

Detect serial changes, serial claims within and across policies as risk and cost indicators for inclusion in origination and claims decisioning.

Book Studies

Streamlined and much more efficient approach to compliance, DOI requests, actuarial, risk scoring and other studies.

Suspicious Relationships

Graph based – frequent connections, pattern recognition that can be used to update risk scoring and customer interaction (Happy vs. Hard paths).

Fraud Networks

Monitors for high risk connections and connection trends and alerts business teams.

Known Fraudsters

Flags previously investigated persons, entities and alerts when observed in an activity or closely connected to the observed.

Opportunistic Fraud Prevention

Identify recycled assets, undocumented assets/inventory and images/image capture.

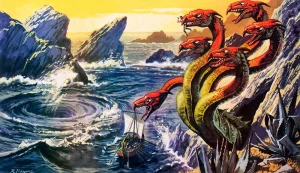

Caught between the Devil and the Deep Blue Sea

Caught between the Devil and the Deep Blue Sea  When the workplace has no walls: Risk management must address the remote revolution

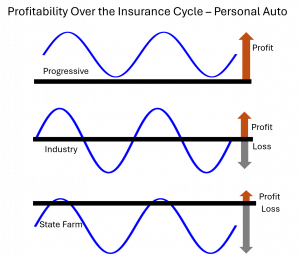

When the workplace has no walls: Risk management must address the remote revolution  State Farm finally turns the corner but faces a long-term problem

State Farm finally turns the corner but faces a long-term problem  The Accident Date Switcheroo

The Accident Date Switcheroo  Where’s Progressive?

Where’s Progressive?  Three AI Mistakes We See Insurance Carriers Making

Three AI Mistakes We See Insurance Carriers Making  Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse

Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse  The “Just Asking” Gambit

The “Just Asking” Gambit