SAN FRANCISCO — Yogi and Carolyn Vindum were still asleep late last year when their Tesla Model S beamed an alert that charging was interrupted. Twelve minutes after that, they awoke to a blaring car alarm and a fire consuming their house in San Ramon, Calif. The blaze had started in one of the two electric vehicles in their garage and spread to the other.

Large Lithium batteries are being used more and more by consumers and represent a new and poorly understood risk to homeowners that insurance carriers need to address Right Now. This is because while not common, when a lithium battery catches fire, it burns for a very long time at a very high temperature and is virtually impossible to put out until the fuel is gone. The Washington Post details a particularly frightening instance of this:

“If we had lived upstairs in this house, we’d be dead,” said Yogi Vindum, a retired mechanical engineer.

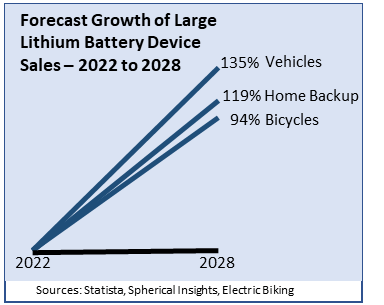

And the problem isn’t just limited to e-vehicle batteries: e-bikes and home battery packs used to provide back-up power when the grid fails are also becoming much more common in homes.

“The number of lithium-ion battery-based fires is growing with enormous frequency both in the United States and internationally, particularly when it comes to e-bikes and e-scooters.”- CNN

In addition, apparently charging increases the chance of a fire and most owners charge their batteries overnight in their garages.

“Lithium batteries are generally safe and unlikely to fail, but only so long as there are no defects and the batteries are not damaged or mistreated,” said Steve Kerber, vice president and executive director of Underwriters Laboratory’s (UL) Fire Safety Research Institute (FSRI). “The more batteries that surround us the more incidents we will see.”

Finally, the probability of a fire grows with the number of different large lithium battery devices in the home. A household with 2 e-vehicles, 2 e-bikes and a power backup battery-pack theoretically has a much greater chance of suffering a fire.

What Carriers Should Do Now

First and foremost, carriers should immediately begin documenting their new and existing policy holder’s ownership of these devices. Carriers should pursue targeted Risk Discovery so as they get more experience with the Lithium Battery loss profile, they’ll have ready access to the data and learning necessary to better manage Risk Selection it in new and renewal policies.

Carriers also must consider the entire Lithium Battery eco-system: how expert are the people installing them in homes? Are there certifications? What level of accident damage to an Electric Car signal an elevated risk of battery fire? The answers to these types of questions are not well understood but the risk is still there, and carriers will still have to pay.

Documenting risks like large e-batteries in the home up front is critical for eliminating a key unmeasured risk.

Things Carriers Need to Do Right Now is a series about new and emerging risk selection issues and opportunities to mitigate them in the personal lines insurance industry. The cost of risk discovery is dropping fast due to the rapid growth of a wide array of highly efficient, automated cloud services – and we believe carriers must take advantage of them to improve risk selection, empower claims and drive profitable growth. We welcome the opportunity to share our ideas about how they might apply to your business.

VeracityID offers idFusionTM: an automated risk selection toolset that allows business teams to detect and rapidly compose highly targeted solutions to stop hundreds of different errors, premium leaks, and frauds – all before a new risk is bound. idFusion integrates seamlessly with personal auto and homeowners core systems.