Advanced New Risk Detection Capability

Tools to detect highly anomalous quote, application, endorsement and billing behavior

- Many (VINs, addresses, drivers) to one (VIN, address, phone, ip) situations

- Robust integrated watch list detection and in transaction resolution with real time image capture and document reader functionality

- Timeline networked ‘risk development’ view

Complete ‘one click’ customer file

- Over 70 data elements

- Including NPW, NPE, and Claims Policy lifecycle view with historical policies included

- Every rule violation and third-party data purchase archived

- All at your fingertips

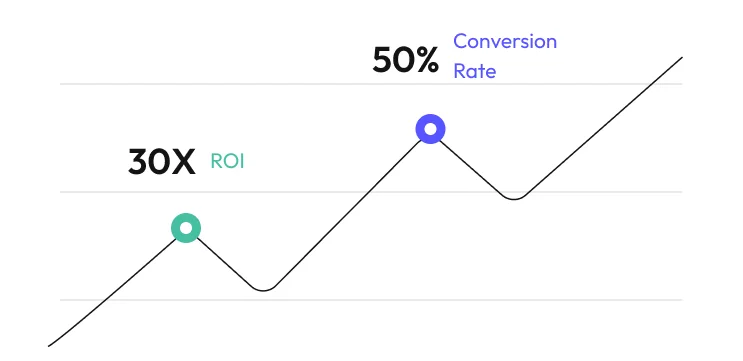

Instant How Many/How Much Analysis

- idRuleBuilder allows trained staff to determine how common a condition is

- It also allows them to determine its financial impact

- In minutes

Permanent Problem Resolution

- Draft business rules that detect the identified condition during transactions

- Draft intervention scripts and data pulls to resolve the condition in transaction

- Test using How Many/How Much

- UW can review, modify and deploy using the same idFusion Hub – they speak the same language

idFusion Helps SIU:

Detect potential new problems up front

Interdum tortor, sed mi consequat gravida viverra etiam ac pharetra. Faucibus mi arcu elementum netus mi rhoncus, volutpat.

Immediately gather all policy data

Interdum tortor, sed mi consequat gravida viverra etiam ac pharetra. Faucibus mi arcu elementum netus mi rhoncus, volutpat.

Instantly determine book level impact

Interdum tortor, sed mi consequat gravida viverra etiam ac pharetra. Faucibus mi arcu elementum netus mi rhoncus, volutpat.

Solve the problem once and for all.

Penatibus nibh volutpat sit quis id cursus. Vitae, sollicitudin egestas posuere amet risus. Magna elementum aliquam, sit mi dolor, dolor viverra quis congue. Sit sed aliquet feugiat lacinia consequat molestie.