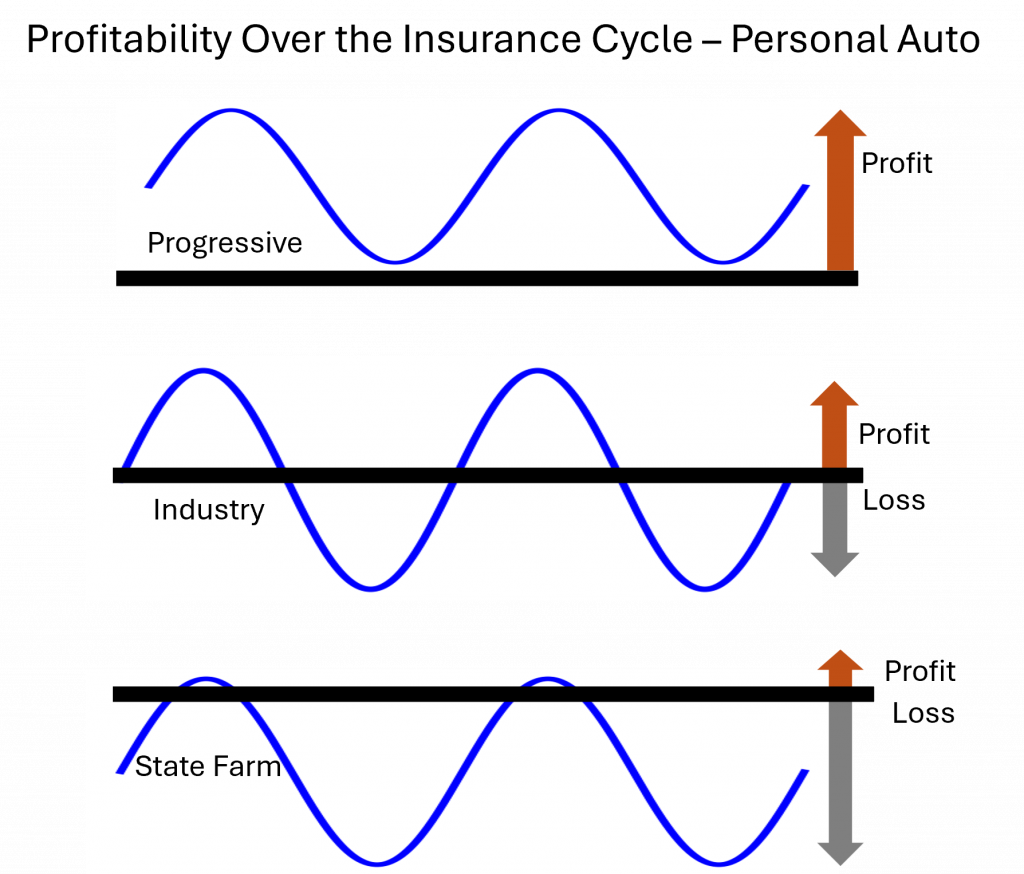

P&C Specialist highlights State Farm’s recent return to profitability, marking a positive shift during an exceptionally strong year for the industry. However, the cyclical nature of the insurance sector presents ongoing challenges. Historically, State Farm’s financial success has been limited to the peak periods of the cycle, particularly within its personal auto business. This pattern is partly attributed to the company’s reluctance to scale back during downturns. Industry consensus suggests that expanding faster than the market can result in an accumulation of high-risk policies during prosperous times, which subsequently leads to significant losses when conditions deteriorate. State Farm’s substantial losses serve as a clear example of this principle.

In contrast, Progressive has demonstrated consistent profitability and robust growth regardless of market conditions, challenging conventional industry wisdom. Progressive’s advantage lies in its superior risk selection and management capabilities. Over the past decade, Progressive’s personal auto segment has achieved combined ratios that outperform the industry average by 5 to 16 points, all while maintaining annual growth rates of approximately 20 percent.

Geico presents a different case. While previously matching Progressive’s profitability and growth rates, Geico experienced significant losses during the last downturn. The company recovered quickly but acknowledged shortcomings in its investment in technology to identify and manage excess losses. Geico now appears to be operating under the traditional ‘rules’, where profitability is attainable in favorable markets, but rapid growth can lead to losses during downturns.

Ultimately, long-term success in insurance depends on effective risk selection and management throughout the policy lifecycle. Progressive has mastered this approach, while State Farm continues to face challenges. Geico is actively working to improve its capabilities, and most other carriers have yet to make significant progress in this area.