Why are carriers doing so much expense reduction? Simple, it’s a proven and relatively quick strategy for getting results when profitability is bad. With headcount and other expense reductions senior managers know what results they’re going to get; they know they can keep their promises.

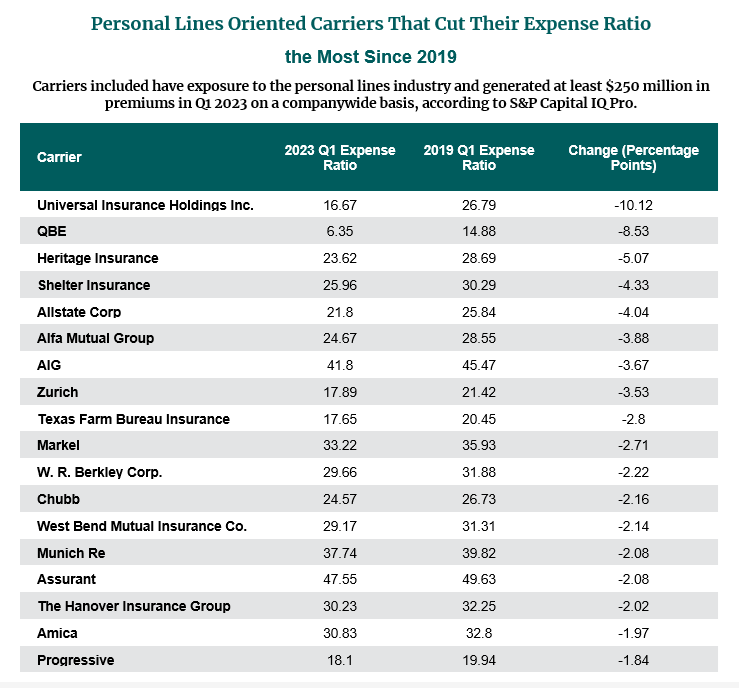

But the problem is that expense reduction runs rapidly into diminishing returns as the collateral damage caused by quick cuts rises and the available opportunities shrink. Look at this summary of the top cost cutters in the P&C Insurance industry since 2019 from P&C Specialist (the full list is at the link) – for the ones with personal auto businesses, the auto losses swamp these cuts.

All the leverage is in the loss ratio

There is no getting around the fact that the great majority of the profitability leverage in insurance is always in the 75-80% of costs that are driven by the risk. And in Personal Auto, those losses are driven by roughly 12% of policies. A 1% improvement there is four times as impactful as the same 1% improvement in expenses. To make any meaningful competitive progress carriers must drive loss ratios down. And to do that they must identify and resolve the half of all loss policies that have significant undetected, unmanaged risks. This requires far more detailed automated evaluation of risks both at POS and at Endorsement – the two places where the many different kinds of unmeasured risks can be detected and resolved. We call this Advanced Risk Selection.

Better risk selection drives better expense results

But Advanced Risk Selection offers even better news because driving out bad risks also yields significant operating expense savings. Selecting and managing risks better delivers superior results by:

- Reducing claim volume and associated LAE by avoiding serial claimants.

- Reducing data consumption – pushing data purchases later in the process after bad risks are washed out.

- Eliminating unproductive lead purchases – not buying leads for risks that are likely to go bad.

- Eliminating other wasted staff hours spent dealing with other risk selection failures like non-payment.

A fundamentally different approach.

We know these results are achievable because we’ve achieved them across IA, EA, and Digital-Direct channels. The key is assembling the right combination of analytics, user composable solutions and real time in-transaction interventions to drive consistent, sustainable improvement. And since there are so many risks across multiple channels and states, the carriers who can reconfigure the dozens to hundreds of specific solutions needed without resorting to expensive, slow IT intervention gain a massive edge.