In today’s unpredictable world, carriers must ensure that both personal lines—home and auto—are not only adequately covered but also meticulously assessed for risk. Achieving organizational success hinges on a comprehensive underwriting transformation that addresses the interconnected nature of these risks.

State Farm’s recent $4 billion underwriting loss in the second quarter, primarily driven by catastrophic weather events impacting their homeowners’ portfolio, serves as a stark reminder of the vulnerabilities that all carriers face. This scenario underscores a crucial truth: substantial losses in homeowners’ insurance can jeopardize the financial health of an entire carrier, irrespective of the performance of their auto insurance segment or marketing efforts.

Unchecked losses in either homeowners or auto insurance can trigger a dangerous domino effect—dwindling profits, increased premiums, and customer attrition. Yet most carriers’ risk selection and management efforts are surprisingly modest given the enormous sums at risk.

Building Resilience: The Power of Proactive Underwriting and Risk Mitigation

The key to navigating today’s challenges lies in developing a robust, organization-wide risk mitigation strategy that prioritizes proactive risk assessment and action. This approach requires moving beyond siloed operations as well as taking a comprehensive view of risk across all lines of business.

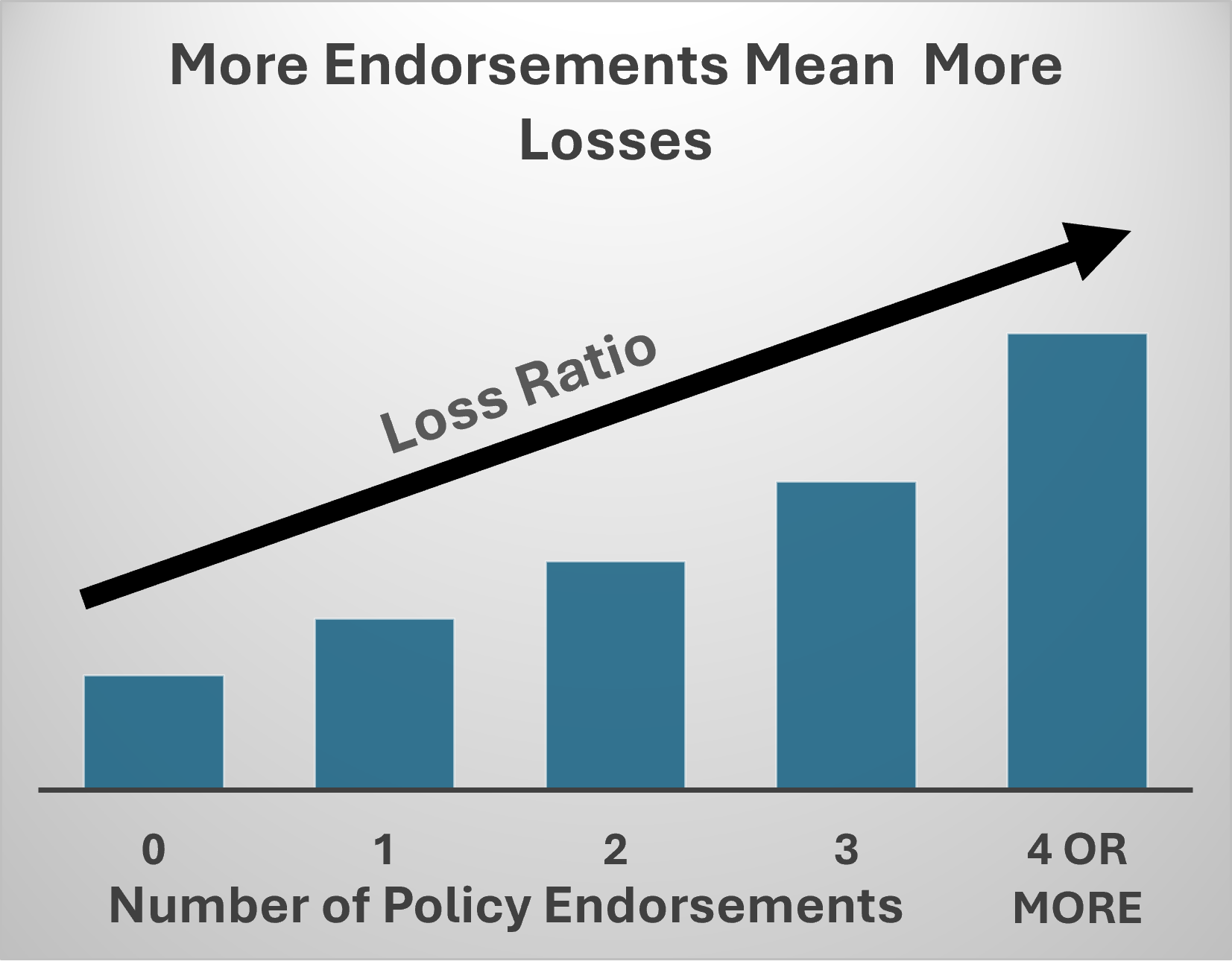

The Numbers Can Be Huge: Endorsement Management

Take for example how the number of endorsements a policyholder makes within a given policy period affects the loss ratio experienced: using idFusionTM we have found that while policies with no endorsements are very profitable, those with two or more endorsements are unprofitable with the losses growing rapidly the more endorsements that are made in a given policy. Yet most carriers do not scrutinize policy holder changes carefully.

The Numbers Can Be Huge: Pre-catastrophe Asset Documentation

Another obvious opportunity to improve outcomes is by carriers getting a better understanding of the risks they are underwriting before disaster strikes. Using our risk documentation applet: idFetchTM enlists policyholders to document their covered property in advance which both illuminates pre-existing damage and enables much more efficient remote initial claim evaluation on large numbers of properties during a catastrophe. It’s a simple, customer driven process that can pay large dividends.

Partnering for Success: VeracityID’s Innovative Solutions

Innovative solutions like VeracityID’s idFusion and idFetch platforms offer carriers the tools needed to reinforce their underwriting and claims processes:

idFusionTM Is a risk selection and management platform utilizing advanced data analytics to delve deeper than traditional demographics and credit scores, uncovering and automatically resolving specific excess risk conditions. This allows for precise risk pricing and customized coverage options.

idFetchTM Is a user managed applet that lets policyholders create detailed pre-loss documentation of their covered property, encouraging proactive risk discovery and substantially streamlining claims handling. idFetchTM enhances customer trust and engagement, improving both the speed and customer experience of claim settlements.

Embrace Proactive Strategies to Secure the Future

By adopting idFusionTM tools and strategies, carriers can:

- Safeguard their financial health: Minimize losses and secure long-term financial stability.

- Improve customer satisfaction and renewal: Build trust through transparent pricing, proactive risk management, and efficient claims processes.

- Stay competitive: Attract and retain high-quality customers with personalized coverage and a commitment to resilience.

In a world where technology leaders like Progressive generate vastly better underwriting results, the industry’s passive risk selection and management approach is a recipe for continued decline and eventual collapse. The ongoing catastrophic loss crisis simply reinforces the urgent need for carriers to become much more proactive in detecting and managing risk and changes in risk across the entire policy lifecycle.