Recent shocks from Covid, the Ukraine conflict, and the recession have severely damaged most personal line carriers’ profitability. For example, Geico, a unit of Berkshire Hathaway, has traditionally thrived with a strategy of high marketing spend and low-cost direct channels, leading to strong growth in premiums and profitability. However, the combination of Covid, the recession, and a shifting direct channel risk environment has resulted in unusually high combined ratios for the past two years.

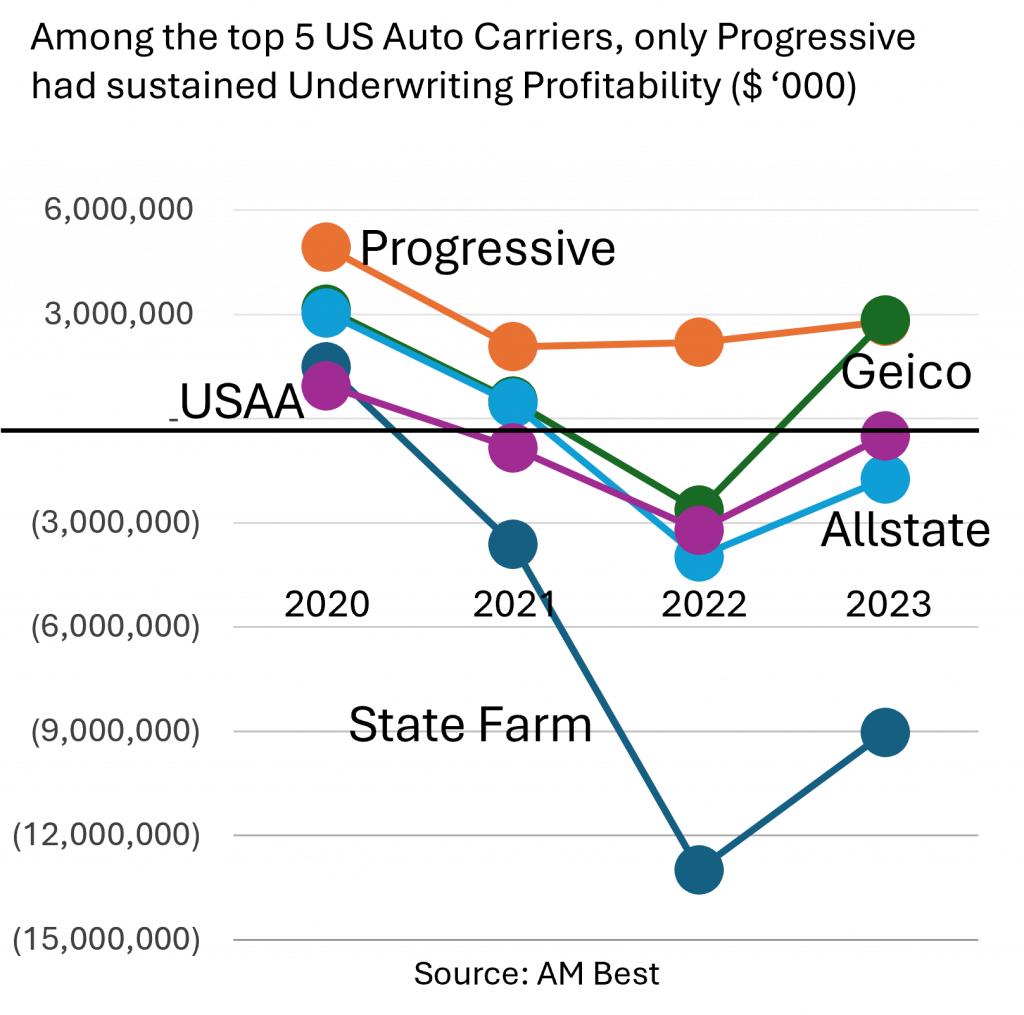

But one carrier appears to have pursued a different approach: Alone among major carriers, Progressive came through the Covid Inflation Backlash unscathed. We believe this is because uniquely among carriers, Progressive uses technology micro-manages risk both at POS and across the entire policy lifecycle. By doing so, Progressive naturally eliminates quite a bit of excess, unmanageable risk. In contrast, most carriers try to manage risk a little at point of sale but then do not follow up on all of the other signals that customers give off during the life of the policy.

When industry conditions worsen, carriers often respond by making sweeping cuts: reducing costs, downsizing staff, and cutting ‘marginal’ business that seems too risky in the current climate. The goal is to ‘batten down the hatches’ and weather the storm, hoping to rebound when conditions improve. Unfortunately, this broad-brush approach can be costly, leading to the loss of valuable business along with the undesirable.

This is doubly true when you compare Berkshire and Progressive’s top line: Going into Covid Berkshire’s Auto revenue was 8% larger than Progressive, after all the emergency surgery, Berkshire was 26% smaller than Progressive. That, and losing roughly $4 billion in profitability vs trend is a whole lot to pay for not focusing on every risk at every point in the policy life cycle.

Clearly the consistent application of ‘microsurgery’ as individual excess risks appear in applications, endorsements or renewals is far preferable to panicked amputation after things have gotten out of control. The key is to use highly flexible cloud tech like our idFusionTM platform. Tools that enable business teams to find, develop, test, and deploy targeted solutions rapidly with minimal IT involvement. This approach allows carriers to make precise adjustments, eliminating less desirable business without affecting more valuable segments.

idFusion™ empowers personal lines insurance professionals to swiftly identify and create highly targeted risk selection and virtual underwriting solutions without heavy IT support. These solutions help reduce loss ratios, deter fraud, and manage risks more effectively, allowing you to capture more of the business you want. For more information, visit www.veracityid.com.