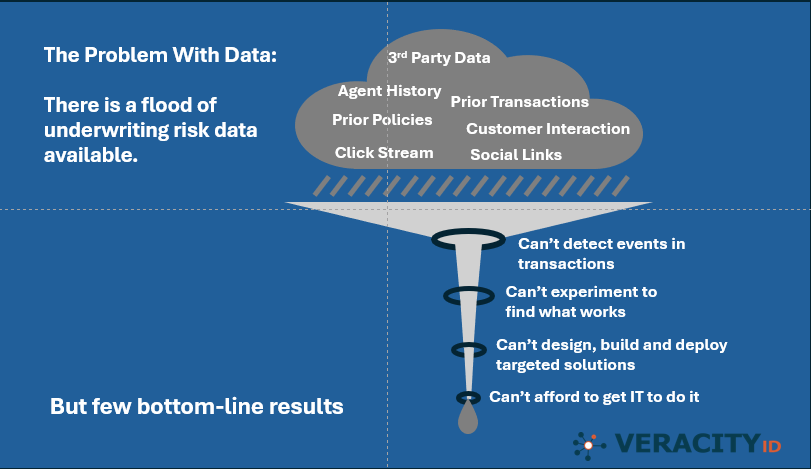

The insurance market is filled with data venders gathering risk-related data on insurance customers to ensure that underwriting decisions are accurately tied to the risks being undertaken. From AAIS building a new database for gathering garaging data for auto insurance, to the many solutions companies like Lexis, Transunion and Verisk offer. With new ones popping up all the time. But the biggest problem carriers have isn’t getting more data or even how to use computing power and data science talent to derive insights from it. No, the real problem is in figuring out how to detect issues during insurance transactions and then automatically resolve them so they can write more profitable business.

Insurance transactions – particularly in personal lines – have become very digitized and rapid. Often insurers are combined on a panel of options by online aggregators and forced to ‘bid’ for the business up front. Even the application process at agents has become almost totally automated. There is little time to stop and consider an elevated risk situation.

This rapid acceleration of the process creates problems:

Finding usable in-transaction ‘tells’

- Which ones work inside each transaction type’s time window?

- Which are most predictive?

- Which are most cost effective? – either in terms of purchased data or in terms of the tracking and evaluation effort needed?

- Which of these are acceptable to regulators?

Developing effective interventions. Even if they could detect risks, most carriers have few tools to respond to an elevated risk indicator within transactions. The most common ‘tool’ carriers use is the ‘knock out rule’ where the customer is simply rejected or subjected to such a tedious process that they abandon their application (aka ‘Friction).

The problem with ‘knock-out’ is that it throws the baby out with the bath water. Because many customers that are ‘knocked-out’ can with appropriate intervention and resolution can be converted into good risks. But to sort the small subset of bad risk from the rest, carriers must execute very targeted interventions. They need tools that can:

- Ask specific questions about an issue.

- Gather additional documentation or images to resolve a question.

- Present specific exclusion or other documents for problematic risks.

- And on the positive side, offer value-adding features to customers whose risk profiles are particularly attractive.

- All in the few minutes of an insurance transaction.

Even worse, carriers lack the tools and innovation process to create the many solutions that are needed. Inventing the solutions to dozens of risk, cost and service issues requires the ability to build, test and measure many possible alternatives. And this requires both flexible user-controlled tools and a culture that supports and rewards innovation. But traditional carrier innovation occurs in an expensive and time-consuming IT process. A process that provides little space for following ‘hunches’ or trying new things.

In the IT change world only the most ‘slam dunk’ opportunities can survive such a process. This necessarily excludes experimentation and the generation of alternatives. Therefore, carriers need tools that let business teams independently:

- Design rules and apply them to past transactions to safely calculate the ‘lift’ from finding and resolving a given risk issue.

- Set up scenarios that passively test a series of alternative ‘tells’ and ‘rules’ so that carriers can compare the likely impact of different options.

- Quickly create pilots and run A vs B comparative studies to see how different solutions work in the real world.

- Monitor and compare the results consistently.

Until carriers give their most talented front-line staff the tools and encouragement to use their knowledge to experiment and discover the best, most efficient ways to detect and manage risk, they are going to waste most of their ‘data science’ investments.