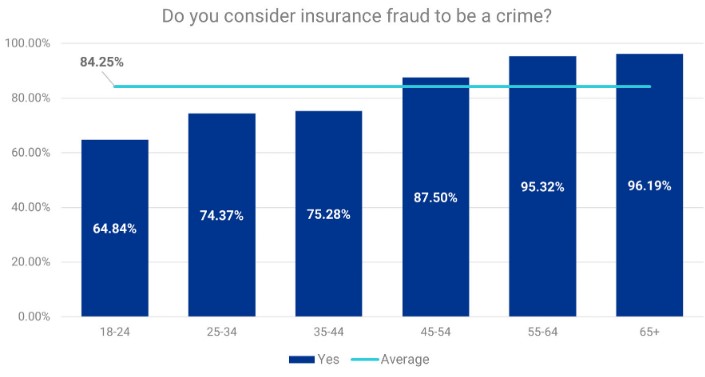

Carrier Management recently published a poll that showed a shocking difference in the honesty of young insurance consumers versus older ones. When asked the question “Do you consider insurance fraud to be a crime” 96% of those over 65 said yes but only 65% of adults under 25 answered in the affirmative. More than one third of Generation Z consumers don’t think insurance fraud is a crime.

But why? We believe that younger auto insurance customers are changing. And are changing in ways that require carriers to change their Risk Selection approach:

- They are much better internet users than their elders.

- Their concept of what insurance is has changed.

Increasing internet sophistication is driving more manipulation.

The smart phone revolution has given most Americans an hour or more a day of experience using the internet to solve problems. This is leading to more and more customers engaging in ‘wargaming’. Wargaming is our term for when a customer goes to a carrier’s site, gets a valid quote, then requests a second quote after changing a piece of information – say the territory or dropping a driver. By doing this a couple times, consumers can get a good feel for how an insurer calculates their premium, resulting in more and more well-informed data manipulation. We see it happening all the time. And it is costly,

The Affordable Care Act (aka “Obamacare”) is changing the way that customers understand ‘insurance‘ Younger customers’ concept of ‘insurance’ also appears to have changed. The traditional understanding of casualty insurance whether it was health, auto or home was that the policy only covered events that happened during the policy life. Preexisting conditions (healthcare) and damage (P&C) were understood to be excluded from coverage. But with the advent of Obamacare, the health insurance market has done away with the concept of preexisting conditions. Instead, health insurance covers any health need during the life of the policy. Consumers may now be comparing their health insurance policy to their P&C policy with its preexisting damage exclusions and asking, ‘why doesn’t my auto insurance cover this?’

Another aspect of Obamacare may be driving consumers to think differently about insurance. Obamacare limited the difference in health premiums between the sick/old and healthy/young to three times the healthy/young premium. Consumers compare that to auto insurance’s much greater rate disparities and conclude that it’s ‘unfair’.

Many customers’ concept of what is ‘fair’ is changing in ways that hurt carrier bottom lines.The result is that many consumers have been persuaded that things that in the past that they would have considered dishonest are in fact the way things ought to be. That filing preexisting damage claims and manipulating data isn’t so wrong after all. And with their much better insight into how their premium is calculated, they’re in a much better position to do so.

One caution: while the theories we’ve proposed here are supported anecdotally by the data and interactions that we see in our customer relationships; we do not know of any scholarly study that directly addresses these issues. We’re hoping to encourage enterprising academics to take up the challenge of understanding these market changes.

We believe that carriers urgently need to upgrade their Risk Discovery and Risk Selection capabilities at POS. Because younger drivers more ‘relaxed’ attitude towards insurance fraud is contributing to poor P&C Personal Lines profitability. And as older consumers are replaced with their grandchildren this problem can only get worse. So, web believe carriers must enhance their Automated, Real Time Risk Selection capabilities by making them more ubiquitous, targeted and internet savvy.

VeracityID offers idFusionTM: an automated risk selection toolset that allows business teams to detect and rapidly compose highly targeted solutions to stop hundreds of different errors, premium leaks, and frauds – all before a new risk is bound. idFusion integrates seamlessly with personal auto and homeowners core systems.