Company Overview

VeracityID was founded in 2013 by a group of seasoned executives with decades of experience in ‘Big Data’ analytics, SaaS software development and delivery of high impact solutions to global financial institutions and technology companies.

Our strength resides in our ability to convert our world-class technologies into sophisticated information intelligence solutions that meet the complex needs of large enterprises. From our roots in cyber security software, US National Security operations, and across the global financial institutions landscape, we have crafted a fraud prediction and prevention toolkit that has solved one of the oldest and vexing problems facing every bank, insurer, merchant and now online services provider, namely: “How can I predict, prevent and mitigate fraud before I commit to sale, and then how can I monitor changes in customer risk level as circumstances change?”. Our deep understanding of the industry – combined with our leading-edge work developing anti-fraud solutions – has enabled us to design and deliver a purpose built, highly sophisticated SaaS solution to this problem.

VeracityID’s idFusion platform offers a revolutionary approach to the continuing global war on fraud, and is based on the simple idea that you can discern and measure fraud risk by viewing a prospective customer’s digital footprint from multiple perspectives using cutting edge ‘big data’ tools. idFusion enables customers to discern hidden relationships between people and data that traditional methods and other software tools often miss – and these are the gateways to fraud discovery. idFusion is built for real-time analysis at point-of-sale, and has been configured with a strong focus on the type of world-class systems/data/application security, virtually limitless scalability, compelling ease of use, and highly configurable workflow that the large enterprise demands.

VeracityID is headquartered in Reno, Nevada with offices in Cupertino, CA, London, UK, Houston, TX and a development center in Romania

News & Insights

Caught between the Devil and the Deep Blue Sea

P&C Specialist has an important article about how State Farm is intensifying is aggressive auto insurance pricing strategy which has lost tens […]

When the workplace has no walls: Risk management must address the remote revolution

It’s getting harder to tell where work ends and risk begins. A recent article from PropertyCasualty360 outlines how the post-COVID work environment […]

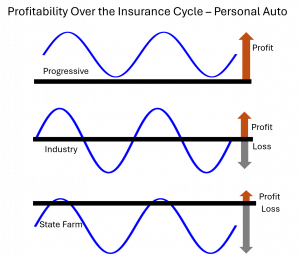

State Farm finally turns the corner but faces a long-term problem

P&C Specialist highlights State Farm’s recent return to profitability, marking a positive shift during an exceptionally strong year for the industry. However, […]

Caught between the Devil and the Deep Blue Sea

Caught between the Devil and the Deep Blue Sea  When the workplace has no walls: Risk management must address the remote revolution

When the workplace has no walls: Risk management must address the remote revolution  State Farm finally turns the corner but faces a long-term problem

State Farm finally turns the corner but faces a long-term problem  The Accident Date Switcheroo

The Accident Date Switcheroo  Where’s Progressive?

Where’s Progressive?  Three AI Mistakes We See Insurance Carriers Making

Three AI Mistakes We See Insurance Carriers Making  Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse

Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse  The “Just Asking” Gambit

The “Just Asking” Gambit