idFusion unites the entire organization around the "Power of Now"

- A complete, common customer data view

- Common analytical tools

- User composed (no programming)

- Designed for real time decisions and intervention at POS

Quote Manipulation

Application change monitoring, multiple submission detection, connected application detection and targeted attest collection that deter and delete manipulation.

Undisclosed Driver

Continuous quote monitoring, prior policy tracking, prior claim analysis, actual driver analysis, missing node prediction, idGetData, prefill and targeted attest collection to deter and defeat undisclosed driver misrepresentation.

Identity Verification

Application personalization/ selfie image capture, shared connection detection, targeted attest collection to deter and eliminate identity misrepresentation at POS.

Garaging Verification

Geomapping & GPS, photo analysis, targeted attest collection, multiple address detection and reconciliation, 2nd home services that detect and deter likely garaging misrepresentation at POS.

Enhanced Underwriting

Anomalies trigger additional questions, customer interaction paths, requests for information, pictures, validation via mail/email, other user defined friction to resolve issues before binding at POS.

Pre-existing Damage

Image capture for higher risk persons, vehicle types, garaging types, high-risk neighborhoods, young drivers, vehicles with prior accidents at POS.

High Risk Scores

VeracityID applies AI/Machine Learning methods using customer attributes, history, behavior and past results to predict losses from claims and early cancellation. Eliminates excess losses, unpaid premium, UW and LAE costs at POS.

Commercial Use

Detect high risk of commercial use, utilize images and image collection to evaluate at POS

Claims File Prep

Accumulates a comprehensive file on an existing risk that is available to Claims and SIU to speed resolution and lower costs at claim and in investigations. This is particularly true for catastrophic risk situations.

You can’t always price right

You can’t always price right  The storm exposes the risk. But are you ready for it?

The storm exposes the risk. But are you ready for it?  Auto insurance risks are changing rapidly; to survive, carriers must get far better at picking risks

Auto insurance risks are changing rapidly; to survive, carriers must get far better at picking risks  Workers comp: The ‘Volunteer’

Workers comp: The ‘Volunteer’  Class code chicanery

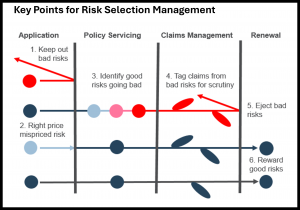

Class code chicanery  There are six critical points where excess insurance risk can be mitigated – but you must focus on them all

There are six critical points where excess insurance risk can be mitigated – but you must focus on them all  The digital market is here, you need digital armor to compete

The digital market is here, you need digital armor to compete  Workers Comp: Lowballing Headcounts

Workers Comp: Lowballing Headcounts