Why do carriers spend so much time on cost reduction and claims efficiency when most of the money in Personal Lines P&C insurance is made or lost during Risk Selection?

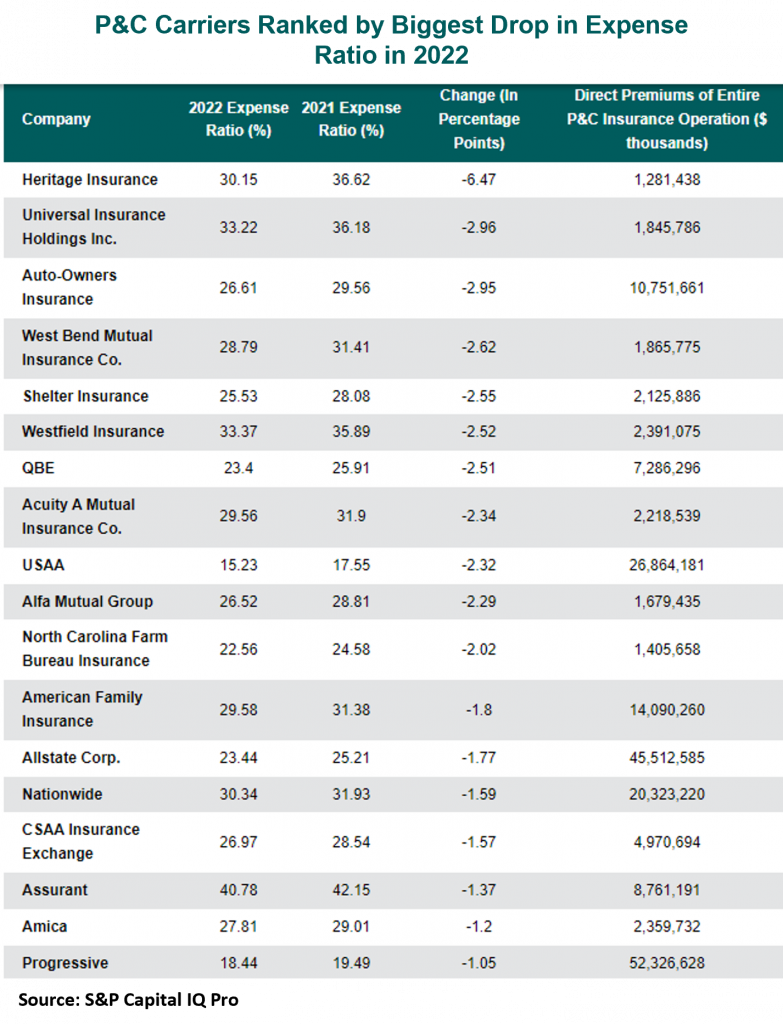

The insurance press is filled with stories about layoffs and cost reductions . Yet when we look at insurance P&Ls it is obvious that most of the money in insurance is made or lost up front in Risk Selection.

Indeed, roughly 80 percent of auto carrier costs are composed of claims losses, loss adjustment expense or agency commissions – all of which are driven by the quality of the risks underwritten. We also know that on average, 16% of a carrier’s policies generate 80% of the losses.

Concrete Costs Versus Uncertain Risks

Historically carriers have focused on the cost side because costs are concrete, can be cut now and managers know how to manage them to a goal. Is there a new claims technology? They know exactly how much processing efficiency it will deliver and the headcount it will save. Contrast that with underwriting and risk selection where a risk premium is a probabilistic estimate of what losses the average customer with a certain risk profile will incur in the future. It’s historically been more of a ‘dark art’ – a black box that carriers have assumed offers limited opportunity for improvement.

But this has changed with the advent of modern core systems that generate large amounts of accurate real time data. Because this data and the real time systems that generate it have created a wide range of profitable opportunities to better manage the risk discovery and risk selection process at POS, Endorsement and Renewal.

We see several technological trends that are giving carriers a much greater ability to “Pick the risks they want and avoid the ones they don’t.”

Personal Technology Enabling Self Service Risk Discovery

Historically it’s been difficult to resolve questions about a risk at POS. This has been particularly true for Homeowners insurance. And what carriers don’t know when they write the risk puts them at a disadvantage when adjusting the claim. Fortunately, the smartphones that each of us carry offer an opportunity to gather far more accurate information. For example, VeracityID’s idMobileTM solution sends an applet to a customer’s phone that takes them through a secure, structured image and document capture process. A process which achieves two things: gives the carrier a much better understanding of the risk and demonstrates the prospective policy holder’s willingness to work with the carrier to better manage their risk.

New Data Science Tools Allow Greater Insight While ChatGPT is exciting the pundits, carriers have available more prosaic Machine Learning Algorithms and other powerful tools that can be used to identify customers with a high probability of excess risk. For example, the idFusion Trustmark Risk ScoreTM can identify a wide range of specific excess risk profiles, each with a different mix of highly probable risks allowing carriers to tailor specific risk selection responses to each.

Execution Is Key – You Can’t Save Money if You Can’t Act at POS

One of the most important insights that the development of our idFusionTM Risk Selection Platform has uncovered is that there are many customer and agent ‘behavioral’ indicators of different excess risks exhibited during quote, application, endorsement, and renewal processes. Indicators that can be tied to data to estimate and mitigate the excess risk.

But carriers can only take advantage of these insights if they can create and execute many interventions at POS. Focused execution that cannot be achieved using traditional IT techniques.

“See, Measure, Act” – Fast!

Improved Risk Selection requires that carriers empower business teams to detect and attack risks at POS without relying on IT. It’s a tall challenge but our work to date demonstrates that improvements of 5 to 40 points of combined ratio are available, depending upon the channel and the target customer. Indeed, the Digital Direct channel only makes sense for carriers that are expert at this type of focused, data rich, in-transaction Risk Selection.

VeracityID offers idFusionTM: an automated risk selection toolset that allows business teams to detect and rapidly compose highly targeted solutions to stop hundreds of different errors, premium leaks, and frauds – all before a new risk is bound. idFusion integrates seamlessly with personal auto and homeowners core systems.