idFusion unites the entire organization around the "Power of Now"

- A complete, common customer data view

- Common analytical tools

- User composed (no programming)

- Designed for real time decisions and intervention at POS

Rapid Rules Deployment

Allows carriers to respond to market changes and target unique market or customer attributes in days rather than months. Lets carriers lead the market rather than chasing it by allowing business users to test, deploy, manage and report outcomes of new UW/risk selection rules without IT intervention.

Agency Management Rules

Carriers often present unique contractual/product limitations as part of appointments based on agency experience, scale, type (EA/IA). Cores systems not efficient or fast at creating, managing or maintaining agency rules; MBR not ‘easy’ to manipulate; idFusion allows rules in minutes & clicks…

POS Document Capture & Analysis

Corrects the high incidence of pre-fill errors and omissions, allows for automated capture of data, documents and images needing validation. Automates the reading of documents to detect non-compliant for further action. Allows carriers to reorient staff to high value problem solving while still enforcing and therefore ensuring compliance to key risk rules. This solution allows carriers to expand and improve UW at low marginal cost, trigger Claims action at point of claim and build evidence files for catastrophic loss events.

POS Property Image Capture & Condition Detection

Allows policyholders to document their property in detail prior to a casualty event. This enables a rapid comparison of the ‘before’ and ‘after’ the event images. It allows for much more streamlined triage and remote adjusting during large scale catastrophic events like Hurricane or Wildfire.

Government ID Reader & Analysis

Confirms personal characteristics of applicant, can execute facial recognition vs social media at POS or claim to dissuade fraud. Effective for FDL capture personal characteristics capture / match (e.g., age); helps avoid/deter multiple users of identity on a policy.

Rapid Third-Party Integration

idFusion brings radically accelerates third party integration at much lower cost via our idGetData API platform. This, combined with idRuleBuilder and idResolve allows carriers to test and deploy new third party data enabled solutions in days or weeks rather than months with much less IT intervention.

High Cost to Serve

identifies policy “frequent flyers” that are unprofitable because of many claims, endorsements, cancels and reinstates, etc.

Compliance & Controls

50 DOI’s increasing concerned about redlining, disclosures and more. Allows immediate creation of rules and reports to monitor specific compliance requirements at any jurisdictional level (state, county, city, zip). Enables proactive competitive compliance strategies.

You can’t always price right

You can’t always price right  The storm exposes the risk. But are you ready for it?

The storm exposes the risk. But are you ready for it?  Auto insurance risks are changing rapidly; to survive, carriers must get far better at picking risks

Auto insurance risks are changing rapidly; to survive, carriers must get far better at picking risks  Workers comp: The ‘Volunteer’

Workers comp: The ‘Volunteer’  Class code chicanery

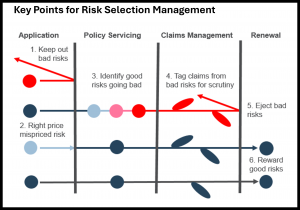

Class code chicanery  There are six critical points where excess insurance risk can be mitigated – but you must focus on them all

There are six critical points where excess insurance risk can be mitigated – but you must focus on them all  The digital market is here, you need digital armor to compete

The digital market is here, you need digital armor to compete  Workers Comp: Lowballing Headcounts

Workers Comp: Lowballing Headcounts