Organize

Fuses and organizes carrier data into a complete customer view

idFusion provides a common and comprehensive policy life-cycle view of customers, including profitability. It makes collaborating with other functions easier and much more productive. We’re finally all on the same page.

- Life-cycle profitability perspective

- All history

- All data and images collected

- Every interaction, every connection

- Every issue and its resolution

Discover

Provides a user composable platform allowing non-IT staff to quickly develop and deploy POS solutions.

idFusion allows business users to rapidly operationalize underwriting automation without the need for costly, time-consuming programming changes to core systems.

- Extensive library of proven business rules

- Proven predictive AI risk models

- Network “Graph” analytics

- Extensive ability to quickly add third party tools and data sets

- Accessible to both standard users and data scientists

Operate

A toolkit of applications, preconfigured solutions and productivity aids designed to help underwriters and related functions accelerate change.

idFusion provides a hub where the various functions can collaborate using the same data and tools to find, value and deliver new value creating solutions at the Point of Sale. And do so without needing to make costly and time consuming changes to core and POS systems.

Integrated Suite of Tools

Detects and resolves critical P&C Risk selection, underwriting productivity and cost challenges.

Includes the API hub to speed the integration of 3rd party data and solutions

Platform Tools

Productivity Tools

The storm exposes the risk. But are you ready for it?

The storm exposes the risk. But are you ready for it?  Auto insurance risks are changing rapidly; to survive, carriers must get far better at picking risks

Auto insurance risks are changing rapidly; to survive, carriers must get far better at picking risks  Workers comp: The ‘Volunteer’

Workers comp: The ‘Volunteer’  Class code chicanery

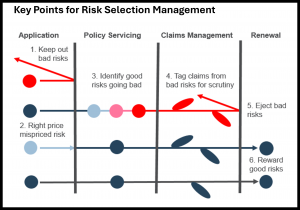

Class code chicanery  There are six critical points where excess insurance risk can be mitigated – but you must focus on them all

There are six critical points where excess insurance risk can be mitigated – but you must focus on them all  The digital market is here, you need digital armor to compete

The digital market is here, you need digital armor to compete  Workers Comp: Lowballing Headcounts

Workers Comp: Lowballing Headcounts  Water Wishful Thinking

Water Wishful Thinking