What is idRuleBuilder

idRuleBuilder gives carriers the ability to design, test and deploy customizable, microtargeted business risk rules and risk resolution workflow to optimize business selection, mitigate fraud and misrepresentation risk, implement agency management and channel controls. and ensure regulatory compliance by combining conditional/Boolean branching logic with the full range of idFusion services into repeatable workflow. And they can do this rapidly and without consuming IT resources or costs

Why do I need idRuleBuilder?

Risk reveals itself in data in many subtle ways. Current application behavior. Prior

policy behavior. Claims experience. Billing behavior, and more. Risks also manifest

themselves differently in the agency channels than in direct business, in new business vs. old business, in different types of coverage models. And agents

operate under different appointment conditions – many carriers are finding it difficult to manage that increasing diversity in their core systems. The regulatory

environment varies by state, too, and requires different types of workflow and

disclosure requirements. And the pace of change in all these environments in

changing faster.

Carriers need the ability to rapidly design, test and deploy new rules to meet changing fraud and market conditions. And they need tools to allow the business

to manage them without long, slow and costly IT deployments.

Benefits

- User defined rules & workflow - trained users can create, test and deploy most business rules and workflow without IT or development support

- An existing library of proven business rules and rulesets is available

- Ultimate flexibility - there is no limit to the number of rules that can be created for different segments, channels, products, coverages

- Rapid design and prototyping - a new rule can be designed, tested against the existing book and be available to test in live transactions in a few days

How is idQuoteMonitor Offered?

idQuoteMonitor is a SaaS subscription service and offered in two versions.

- The first is as ‘idFusion Enterprise’ – the complete suite of services we offer – wherein every quote and endorsement inquiry is compared with prior quotes, policies, billing records and claims history for signs of rate manipulation.

- The second is as a standalone version of ‘idQuoteMonitor’ that is restricted to finding signs of manipulation solely within quote history. Both versions identify persons/entities whose quote submissions contain conflicting/omitted information that impact rate or increase fraud risk. Both versions may leverage other idFusion services including idFetch™ and idGetData to resolve these risks. Both also have the option of integrating carrier SIU data to facilitate identification of previously identified fraudsters attempting to gain new coverage.

How is idQuoteMonitor Delivered?

- idQuoteMonitor standalone requires access to carrier quote history, live quote data (including vendor supplied data) via API to be minimally operational. Its impact is limited to identifying conflicts between quotes – and lacks insights that can be gleaned from adding prior policies, prior claims, billing information, SIU history and more from the carrier data network.

- idFusion Enterprise is VeracityID’s entire platform of financial & data analytics, risk detection and intervention solutions, and case management workflow. idQuoteMonitor services are thereby enhanced by policy, claims and billing history to fully leverage carrier information to detect rate evasion patterns and risks

Case Example

Rapidly Deploy Dozens of Carrier New Agency & Channel Specific Risk Selection and Fraud Management Real-Time Rules – Driving Rapid Innovation at POS and Endorsement

Caught between the Devil and the Deep Blue Sea

Caught between the Devil and the Deep Blue Sea  When the workplace has no walls: Risk management must address the remote revolution

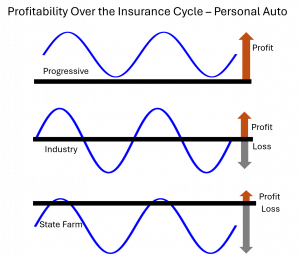

When the workplace has no walls: Risk management must address the remote revolution  State Farm finally turns the corner but faces a long-term problem

State Farm finally turns the corner but faces a long-term problem  The Accident Date Switcheroo

The Accident Date Switcheroo  Where’s Progressive?

Where’s Progressive?  Three AI Mistakes We See Insurance Carriers Making

Three AI Mistakes We See Insurance Carriers Making  Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse

Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse  The “Just Asking” Gambit

The “Just Asking” Gambit