What is idQuoteMonitor?

Studies by leading entities like Verisk/QPC, PWC, the Coalition Against Insurance Fraud and VeracityID’s own experience show that rate evasion and fraud costs the auto insurance industry, on average, 15-20% of NPW every year. idQuoteMonitor enables carriers to detect and prevent rate evasion during live application processes by monitoring anomalies in application data and unexpected changes in and between quotes, policies, claims and other information acquired during the application and/or endorsement process.

Why do I need idQuoteMonitor to manage quote manipulation?

10-15%+ of a typical carrier’s quote volume is from persons who submit multiple quotes – over hours, days, weeks and even months. And many of those quotes include modifications to rating data – .e.g., listed drivers, addresses, coverage types, number of vehicles covered, demographic data and more – that either obscure applicant key information in anticipation of a future claims fraud attempt, or more commonly to search for better pricing.

Customers and agents often reveal rate manipulation intent to carriers who know how to look for it – in quotes, endorsement, third-party data, billing and claims activity. Most such persons know what they are doing and take steps to obfuscate their efforts – with swapped primary drivers, subtle changes in applicant and listed driver names, modified addresses, etc. and other ways to ‘game’ carrier origination systems. idQuoteMonitor applies a cutting edge detection tools to unmask these manipulations during live transactions – and engages the suspicious applicant in a virtual dialog to signal awareness of the deception, allow them an opportunity to remediate their action if it is an honest error (e.g., via a driver exclusion or other correction to rating data), or prevent issuance if concerns cannot be mitigated.

Benefits

- Real time identification of specific risk types across the entire book of quotes, including undisclosed drivers, rating address manipulation, personal status changes (age, marital, etc.) and more,

- Customizable workflow and reporting to manage and analyze risks

- Real-time identification of previously flagged fraudsters through social network (graph database) links to entities identified in SIU, industry and criminal databases

- Automated intervention, resolution and escalation of risks per carrier underwriting direction

Why do I need idQuoteMonitor to manage quote manipulation?

10-15%+ of a typical carrier’s quote volume is from persons who submit multiple quotes – over hours, days, weeks and even months. And many of those quotes include modifications to rating data – .e.g., listed drivers, addresses, coverage types, number of vehicles covered, demographic data and more – that either obscure applicant key information in anticipation of a future claims fraud attempt, or more commonly to search for better pricing.

Customers and agents often reveal rate manipulation intent to carriers who know how to look for it – in quotes, endorsement, third-party data, billing and claims activity. Most such persons know what they are doing and take steps to obfuscate their efforts – with swapped primary drivers, subtle changes in applicant and listed driver names, modified addresses, etc. and other ways to ‘game’ carrier origination systems. idQuoteMonitor applies a cutting edge detection tools to unmask these manipulations during live transactions – and engages the suspicious applicant in a virtual dialog to signal awareness of the deception, allow them an opportunity to remediate their action if it is an honest error (e.g., via a driver exclusion or other correction to rating data), or prevent issuance if concerns cannot be mitigated.

Caught between the Devil and the Deep Blue Sea

Caught between the Devil and the Deep Blue Sea  When the workplace has no walls: Risk management must address the remote revolution

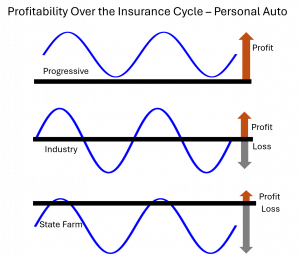

When the workplace has no walls: Risk management must address the remote revolution  State Farm finally turns the corner but faces a long-term problem

State Farm finally turns the corner but faces a long-term problem  The Accident Date Switcheroo

The Accident Date Switcheroo  Where’s Progressive?

Where’s Progressive?  Three AI Mistakes We See Insurance Carriers Making

Three AI Mistakes We See Insurance Carriers Making  Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse

Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse  The “Just Asking” Gambit

The “Just Asking” Gambit