What is TrustMark Risk Scores?

TrustMark risk scores employ rigorous modeling techniques to a wide array of customer application, policy and claims behavioral indicators to assign and continuously update risk levels associated with each driver or claimant in a carrier network.

Why do I Need This Tool?

Underwriters have a host of time-consuming exceptions to manage – with more constantly emerging. The result is that they are unable to adequately address many types of exposure – they simply don’t have the bandwidth. In combination with idRuleBuilder and idMobile, idDocReader eliminates time consuming document review tasks and drives more accurate and complete underwriting of risks.

Benefits

- Identify applicants and endorsements likely to contain ‘bad’ actors or drive suspicious claims

- Materially reduce loss ratios on high risk applications by modifying policy terms and payment conditions during active customer sessions

- Create robust ‘tip & lead’ indicators for when claims or billing events occur on policies with high risk scores

- Identify emerging networks of entities with high risk scores for investigation

Case Example

How a Top Auto Carrier Harmonized Underwriting Standards Across Channels and Writing Companies – Ensuring Risk Selection Consistency

Caught between the Devil and the Deep Blue Sea

Caught between the Devil and the Deep Blue Sea  When the workplace has no walls: Risk management must address the remote revolution

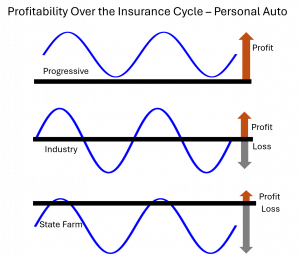

When the workplace has no walls: Risk management must address the remote revolution  State Farm finally turns the corner but faces a long-term problem

State Farm finally turns the corner but faces a long-term problem  The Accident Date Switcheroo

The Accident Date Switcheroo  Where’s Progressive?

Where’s Progressive?  Three AI Mistakes We See Insurance Carriers Making

Three AI Mistakes We See Insurance Carriers Making  Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse

Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse  The “Just Asking” Gambit

The “Just Asking” Gambit