What is idFetch™?

idFetch™ is a highly flexible, user-customizable mobile service that allows carriers to automatically or manually direct secure requests to customer mobile devices and gather authentication, image capture (e.g., manifests of persons, vehicles, documents, properties, etc.) and GPS/device data during the sales process to execute risk assessment and mitigation actions. idFetch™ services are fully integrated with idFusion/idResolve services such that an applicant can begin a new business application on a desktop or a mobile device, continue the process of uploading requested documents/images on the mobile device at any time and in any sequence, and then complete the application on the mobile device or on the desktop at their convenience – seamlessly and easily.

idFetch™ can also be called as a one-off service by any authorized carrier user – in the field, in underwriting or in a call center – and configured from a script or on the fly (via a ‘manifest’ design interface) to request any sequence of document and asset images.

In both cases, requests are automatically pushed to customers, agents and/or third parties via SMS for authentication and then processed by recipients on their mobile device. When completed, image and response manifests are automatically returned to idFusion for analysis and review. Future releases of idFetch™ will include video and audio capture services to support attest, inspection and incident reporting.

Why do I need a mobile solution for underwriting?

Rate evasion and fraud intent can be detected and deterred by gathering specific images of assets, persons, locations and documents from the applicant prior to issue. idFetch™ solutions enable carriers to signal applicants that an asset record is needed (thereby deterring claims and misrepresentation), to capture document images that resolve data conflicts and gaps, and as pre-issue evidence in the event of a claim. It has proven particularly useful in deterring pre-existing damage claims and (soon) to do pre-issue home condition verification.

When integrated with an automated idFusion process, idFetch™ can capture this information in-transaction – before an offer is made, before a policy is issued, before a risk modification is made.

Benefits

- Connects customers, agents, underwriters, call centers, field staff and third parties in a secure virtual mobile communications and sharing environment

- Designed to capture and complete a fixed or ad hoc script of tasks before allowing issue or endorsement tasks to be completed

- Seamless transition to/from web and mobile devices for application processing, Addresses multiple risk types in auto, homeowners and other lines of business

- Automated and ad hoc service call options

- Game-like carrier set-up and applicant mobile app design

- Real-time capture capabilities at customer-defined pace

- Auto-reminders to prompt customer completion of tasks

- Image recognition tools to discern and filter images for completeness, content and quality

How is idFetch™ Delivered?

idFetch™ is offered as a subscription service to insurance carriers and delivered as:

- Stand-alone application enabling carriers to direct mobile interactions and requests between customers, agents, underwriters, call centers, claims, third parties and other authorized parties,

- Module of idFusion suite of fraud detection & intervention services.

Caught between the Devil and the Deep Blue Sea

Caught between the Devil and the Deep Blue Sea  When the workplace has no walls: Risk management must address the remote revolution

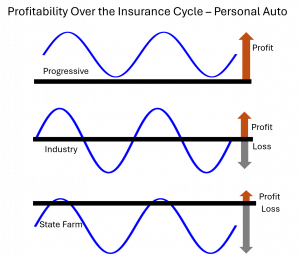

When the workplace has no walls: Risk management must address the remote revolution  State Farm finally turns the corner but faces a long-term problem

State Farm finally turns the corner but faces a long-term problem  The Accident Date Switcheroo

The Accident Date Switcheroo  Where’s Progressive?

Where’s Progressive?  Three AI Mistakes We See Insurance Carriers Making

Three AI Mistakes We See Insurance Carriers Making  Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse

Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse  The “Just Asking” Gambit

The “Just Asking” Gambit