What is idResolve?

idResolve is a highly configurable, flexible and powerful fraud intervention service that is invoked when fraud rules are triggered or suspicious entities are detected during a customer, call center or agent online session via a web interface. idResolve is the key gateway to engaging in online interactions with agents, customers and call center personnel to resolve risk issues.

How is idResolve Delivered?

idResolve is offered with the idFusion platform as a subscription service to insurance carriers. idResolve may be delivered as:

- A component of a limited version of idFusion focused exclusively on new business risk detection. Complementary components include idQuoteMonitor, idGetData and idFetch™.

- A component of the comprehensive idFusion solution – capturing legacy and live policy data – to manage lifecycle fraud risk at the policy, channel, customer, geographic, line of business and inter-book levels using the complete suite of VeracityID tools.

Benefits

- Automatically launched – as iFrame or web window - when specific risk conditions identified at POS, endorsement or claim

- Launches idFusion or third party risk solutions during live transactions to resolve issues

- “Invisible” to customers – configured using carrier stylesheets and color palette

- Controls workflow until risk conditions are satisfied – preventing issuance of suspicious applications/endorsements and flagging suspicious entities for monitoring and conditional action

- Enables addition, modification and testing of new fraud rules, scripts and resolution processes without incremental carrier IT costs

Case Example

How a Top Auto Carrier Turned Its Direct Business Into a Money Maker – Winning in the Direct Channel

Caught between the Devil and the Deep Blue Sea

Caught between the Devil and the Deep Blue Sea  When the workplace has no walls: Risk management must address the remote revolution

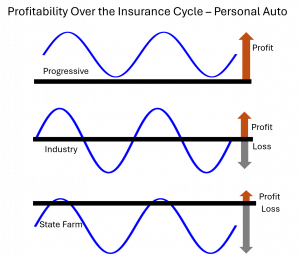

When the workplace has no walls: Risk management must address the remote revolution  State Farm finally turns the corner but faces a long-term problem

State Farm finally turns the corner but faces a long-term problem  The Accident Date Switcheroo

The Accident Date Switcheroo  Where’s Progressive?

Where’s Progressive?  Three AI Mistakes We See Insurance Carriers Making

Three AI Mistakes We See Insurance Carriers Making  Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse

Fast Isn’t Always Smart: Why high speed Claims Tech puts the cart before the horse  The “Just Asking” Gambit

The “Just Asking” Gambit